Our Process

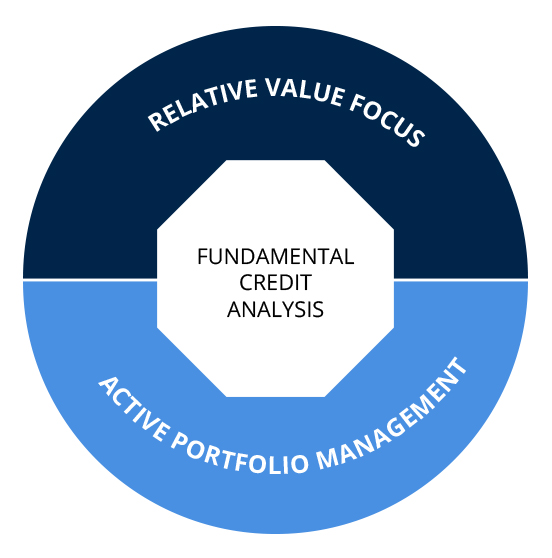

Across all of its funds/accounts under management, Octagon strives to preserve investor capital and generate attractive risk-adjusted returns through fundamental credit analysis, dynamic relative value asset selection and active portfolio management. Octagon employs a disciplined asset selection process based on bottom-up credit analysis and collaborative investment team input to identify attractive relative value opportunities, while seeking to minimize downside risk and produce strong risk-adjusted returns. In evaluating potential investments, Octagon assesses industry dynamics and competitive environments, performance history and prospects, investment sponsors and management, projected cash flow generation, quality and value of underlying collateral, downside protection and relative value opportunities within an issuer’s capital structure (among other considerations). Octagon’s investment philosophy and process encourage and rely on the active internal exchange of information to capitalize on actionable investment opportunities and manage portfolio risk.

Investment Philosophy